Planned Giving

Estate planning is an important process that manages your financial wishes during life and upon your death. Plans can be tailored to your individual situation. There are special types of will arrangements, trusts, or annuities that enable you to set money aside for your future or pay you and your loved one a guaranteed sum for the rest of your lives. Through many of these options you can reduce or delay your tax burden and help the Florida Sheriffs Youth Ranches.

Below are some of the options we would be happy to discuss with you. Consultation is free and confidential.

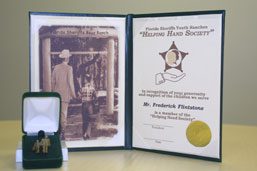

The Helping Hand Society

The Helping Hand Society is a group of friends of the Florida Sheriffs Youth Ranches who seek to ensure that the future needs of youth are met by including the Youth Ranches in their estate plans. This planning can include any of the options listed on this page.

Members receive the following benefits:

- A special pin in the likeness of the Sheriff providing a helping hand to a small boy

- Access to planned giving consultation and materials

- The opportunity to meet our youth benefiting from your commitment

Bequest in a Will

A donor can designate the Florida Sheriffs Youth Ranches as the recipient of all or part of his/her estate. However, this can only be accomplished through a will or other estate planning documents.

The proper legal name of the Youth Ranches is:

Florida Sheriffs Youth Ranches, Inc.

Boys Ranch, FL

The proper way to remember the boys and girls of the Youth Ranches is to include a phrase in your documents similar to the following:

“I give and devise to the Florida Sheriffs Youth Ranches, Inc., Boys Ranch, FL 32064:

*100% of the residual amount of my estate

*A specific amount of $______________

*A description of the property

*A certain quantity of stocks”

(or any combination of the above.)

We encourage you to contact your attorney or personal advisor to assist you in the process of making your will.

Everyone should make a will or living trust. You can click the image below to go directly to the FreeWill website to create your will today!

To find out more information you can download a copy of the flyer by clicking here.

Life Insurance

Life insurance provides many options for a donor to choose from. You may choose to designate The Florida Sheriffs Youth Ranches as the beneficiary, or partial beneficiary, of a life insurance policy. There is no income tax benefit with this option but a possible estate tax benefit. You may also donate existing policies that are no longer needed. Tax deductions may be equal to the policy’s cash replacement value. A donor may also purchase a policy and name the Florida Sheriffs Youth Ranches as the owner and beneficiary; the premiums you pay are fully tax deductible. At the donor’s death, the charity receives the insurance proceeds.

Retirement/IRA Account

You can transfer your IRA at your death to a qualified charity as beneficiary. The Florida Sheriffs Youth Ranches will not incur any income tax on the proceeds because of its tax-exempt status.

Charitable Remainder Trust

Either cash or other assets (appreciated stocks) can be put into a remainder trust, which is irrevocable. During the donor’s lifetime he/she can receive payments, at least quarterly, amounting to five percent or greater, depending on the age of the donor. At the death of the donor, the remaining balance would transfer to the Florida Sheriffs Youth Ranches.

Charitable Lead Trust

Any donor can create a trust naming a charitable beneficiary and specifying the trust terms, then transfer the property to the trust. The Trustee who administers the trust is responsible for the investment of the assets and administration of the trust. The Trustee pays the required amount to the Florida Sheriffs Youth Ranches at specified times and then distributes the remaining balance to the beneficiaries at the end of the trust term.

Charitable Gift Annuity

A donor may transfer a specified amount of money or other property to the Florida Sheriffs Youth Ranches. In return, we will pay the donor a certain amount (annuity) each year for a specified term or for the remainder of your life. At the death of the beneficiary, the Florida Sheriffs Youth Ranches will use the principal in accordance with the terms of the gift. These are only available to donors who reside in the state of Florida. Gift annuities with the Florida Sheriffs Youth Ranches are guaranteed by the assets of the organization. The Youth Ranches was the first organization to be granted a license to offer gift annuities in the state of Florida.

Please note that these planned giving definitions are general and brief. Individual circumstances will govern the extent to which a planned gift provides tax and other financial benefits. Always consult your attorney or tax advisor before making any gifting decisions.

For more information contact us at (386) 842-5501 or (800) 765-3797.

The Florida Sheriffs Youth Ranches, Inc. is a tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code. Donations are deductible for computing income and estate taxes.